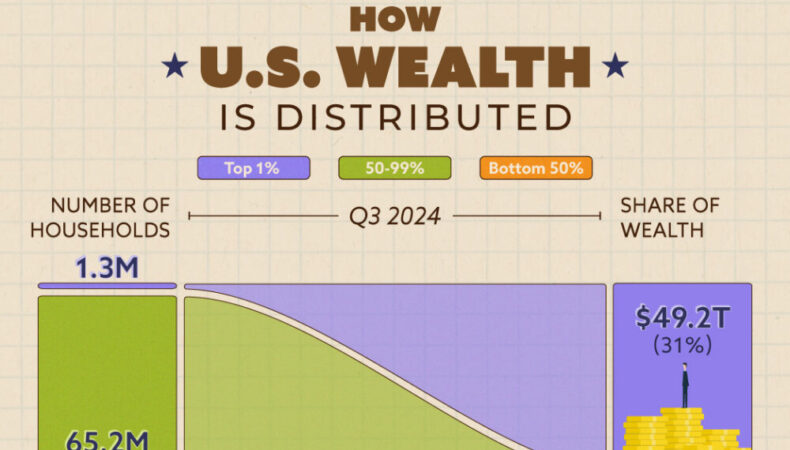

A recent data analysis delivered insight into the distribution of wealth in America, revealing significant disparities across various segments of society.

The analysis, based on data from the Survey of Consumer Finances by the Federal Reserve, examined wealth as a combination of an individual’s assets minus their debts. It was noted that the top 10% of Americans by wealth have about 70% of the total national wealth, with 35% being controlled by the top 1% of households.

This concentration of wealth at the top signifies a marked wealth gap in the US. It is observed that the bottom 50% of households only own 2% of the nation’s total wealth. A closer look at the data reveals that the wealth share for the middle class — comprising 40% of the American populace — is only 29%.

The stark disparity transcends just the overall wealth figures. Analyzing data from the U.S. Census Bureau and the Federal Reserve, it was observed that total wealth held by millennials, aged 23-38, equals approximately $5 trillion, while baby boomers, aged 55-73, have amassed a wealth nearing $70 trillion.

The breakdown also accounts for racial disparities in wealth distribution. The median white family holds nearly 8 times more wealth than the median Black family and 5 times more than the median Hispanic family in the U.S.

Additionally, the data showed significant differences in wealth accumulation based on education. Households led by individuals with a college degree account for 75% of total American wealth, suggesting a strong correlation between education and financial prosperity in America.

Notably, despite these stark inequalities, this concentration of wealth in the US conforms to the Pareto Principle or ’80-20 rule’. This economic principle stipulates that 80% of outcomes, in this case wealth, come from 20% of the input, or people.

The wealth distribution analysis offers a clear view of the depth of economic inequality in America and invites further exploration into rectifying these disparities. As the debate on wealth inequality intensifies, it brings the underlying issues of racial, generational, and educational wealth gaps into sharper focus.Source.

Last modified: March 9, 2025