Established online health startup Hims & Hers Health, with its recent public debut, has been generating buzz in the investor sphere, with speculation around the potential of the stock to generate high wealth returns.

The company, which specialises in telehealth for both males and females, entered the public market through a Special Purpose Acquisition Company (SPAC) merger with Oaktree Acquisition Corp in January 2021. The deal valued the business at $1.6 billion, proving a high stake entry.

The core business model of Hims & Hers revolves around connecting consumers to healthcare professionals online, getting prescriptions for conditions like hair loss and erectile dysfunction without needing to visit a doctor in person. Furthermore, an expanding product portfolio including mental health services and at-home COVID-19 test kits is broadening the firm’s market potential.

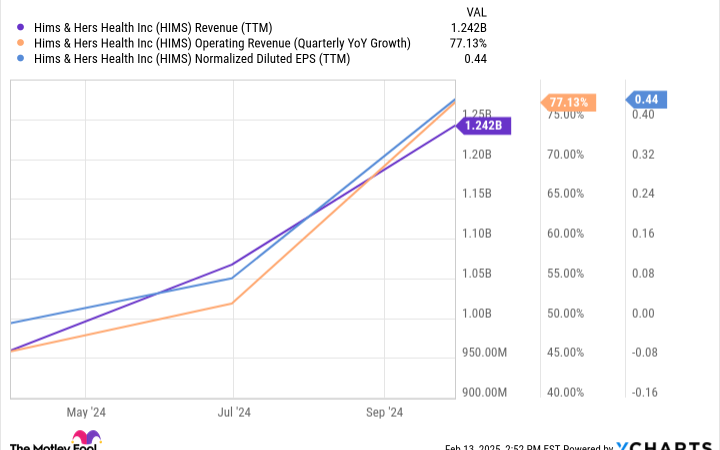

As of its public debut, the company has a $3 billion market cap, which has piqued investor interest. However, despite recent lucrative numbers, some financial analysts caution investors noting that the company is yet to turn a profit. According to its most recent financial filings, Hims & Hers reported $149 million in revenue for 2020, up 67% year over year from 2019, but posted a net loss of $72 million.

The company is optimistic about its growth prospects, with the leadership expecting to increase revenue by 30% to 35% annually over the next five years. This projected growth rate renders Hims & Hers a potential candidate for ‘millionaire-maker’ status, as its stock could experience significant price surge with time.

However, as with all investment decisions, it’s not without risk. There are several factors that can influence the trajectory of the company, including government legislation around telehealth services, competition from other online health providers, and the overall health of the economy. Lastly, while Hims & Hers could be a potential millionaire-maker, the company advises investors to conduct their own due diligence before making any kind of investment decision.

Last modified: February 19, 2025