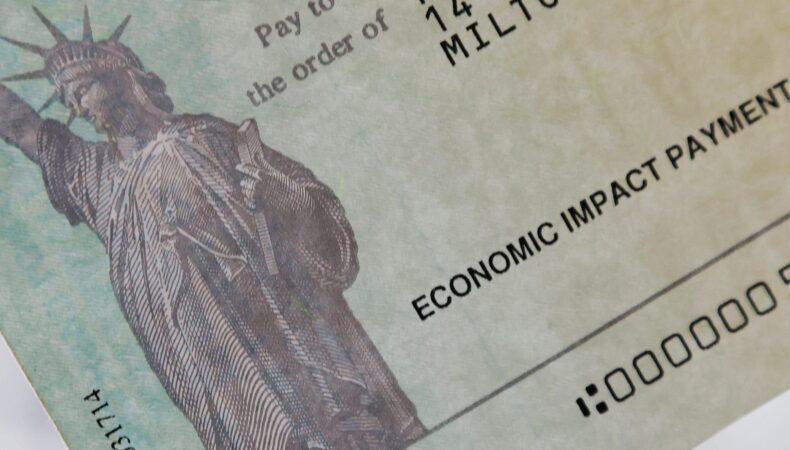

The Internal Revenue Service (IRS) has begun distributing $2.4 billion in stimulus checks to eligible recipients. These checks, part of an economic renewal package in response to the ongoing COVID-19 pandemic, are an extension of the government’s efforts to support households affected by the crisis.

Those eligible for these stimulus funds include individuals who made less than $75,000 on their most recent tax returns, as well as couples who earned less than $150,000 jointly. People who are eligible should expect to receive checks automatically, provided they fulfill the income criteria and are not listed as dependents on anyone else’s tax return.

The management of the issuance of these checks is handled directly by the IRS, without the need for application or qualification beyond meeting the established criteria. The checks are designed to provide immediate financial relief for those disproportionately affected by the economic fallout from the pandemic.

It’s also important to note that the IRS is working rapidly to distribute the checks, although some delays may occur due to the sheer volume of payments to be processed. The IRS has set up a dedicated web tracker that allows eligible recipients to check the status of their payment.

This marks a substantial addition to the financial aid provided by the U.S. government during this unprecedented health crisis. It will underscore the efforts of the government to maintain stability amidst financial disruptions, with additional programs and initiatives expected to be rolled out in the future as the situation develops.

Last modified: January 13, 2025